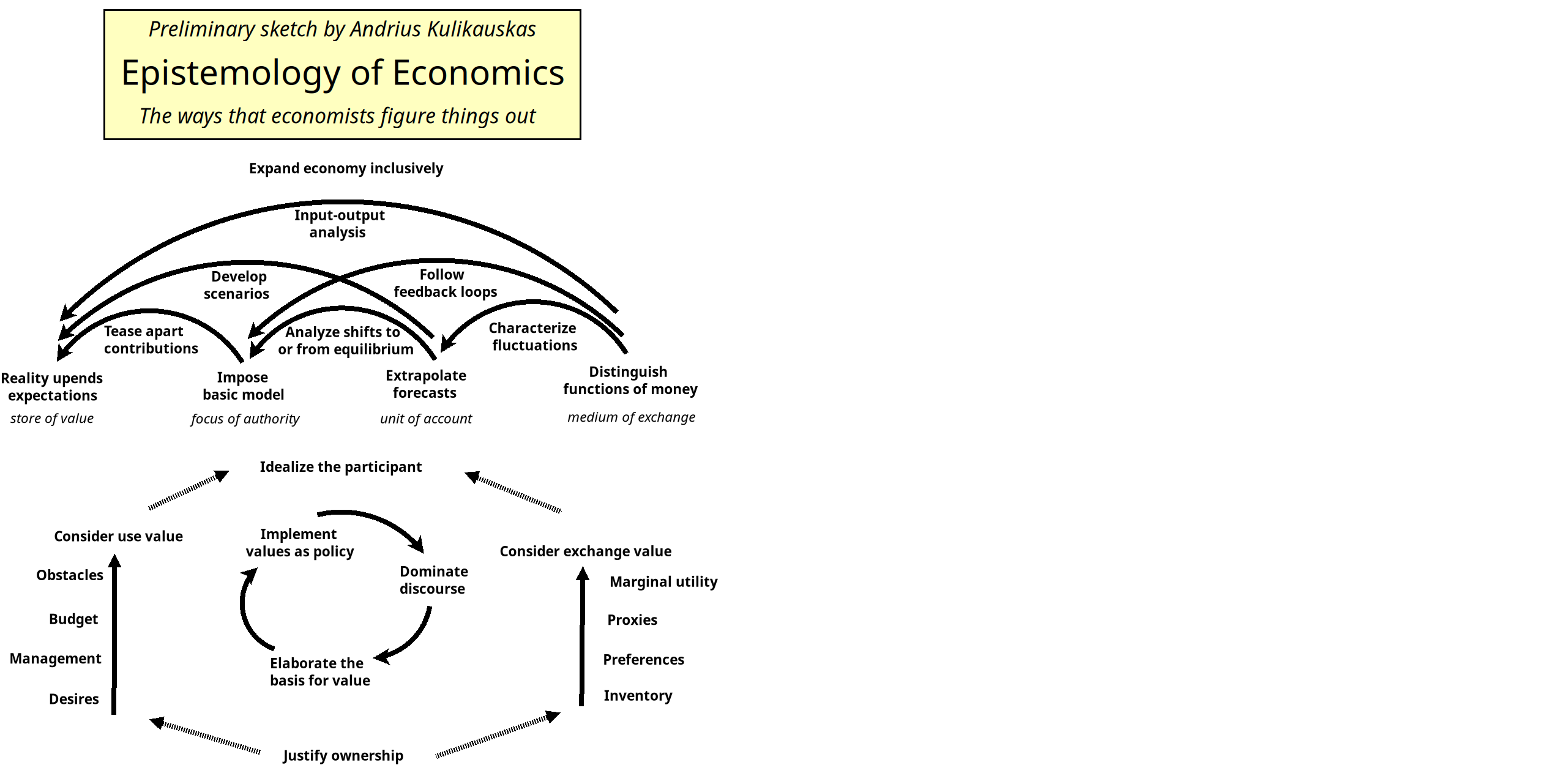

Ways Economists Figure Things Out

We're collecting and systematizing the ways that economists figure things out. Here are examples of how Andrius has sketched the 24 ways of figuring things out for different disciplines and personalities.

Please add more ways that economists figure things out

Additional pages

- Epistemology of Economics An overview of our investigation.

- Reorganizing the Wikipedia list Economic Methodology

- CommunityEconomicsPresentation More about our methodology and practically how to be involved.

- Systematizing Ways Economists Figure Things Out Ideas by Jean-Pierre Caron based on Rudolf Steiner.

Below we are organizing examples of ways that economists figure things out.

The model shows that the four functions of money are answers why money addresses the corresponding ways that economists figure things out. Why do we want a store of values? Because the economy is ever upended. And so on. A medium of exchange is not necessarily between distinct people or entities but fundamentally is between the functions of money, among which is a medium of exchange in its own sake. Money is the representation of the idealized participant in the economy.

Questions

Please note: In the spirit of fair use, we are sharing excerpts from Wikipedia and other sources which illustrate examples of ways of figuring things out. We cite our sources where the excerpts can be found in their original context.

Justify ownership

Ownership, property, wealth

Justify why property belongs to you. Come up with reasons, what matters and what does not matter. You own what you claim.

- But when his disciples saw this, they were indignant, saying, “Why this waste? For this ointment might have been sold for much and given to the poor.” However, knowing this, Jesus said to them, “Why do you trouble the woman? She has done a good work for me. For you always have the poor with you, but you don’t always have me. Matthew 26:11

- Bribe judges

Works and Days

Works and Days

- Explain that injustice and hardship come from the gods.

Works and Days

Works and Days

- Explain that human beings have degenerated and ignore moral and religious standards.

Works and Days

Works and Days

- Quiet those who object. The hawk berated the nightingale in its clutches.

Works and Days

Works and Days

- Argue that it is inevitable.

- It is not merely that the Malthusian principle of population and the doctrine that wages must normally and necessarily fall to the minimum point were gladly accepted by wicked exploiters as the justification of their profits; but thousands whose immediate interests were not touched by these beliefs found it difficult to avoid them.

The Dismal Science

The Dismal Science

- It is not merely that the Malthusian principle of population and the doctrine that wages must normally and necessarily fall to the minimum point were gladly accepted by wicked exploiters as the justification of their profits; but thousands whose immediate interests were not touched by these beliefs found it difficult to avoid them.

- Locke argues that property is a natural right that is derived from labour. In Chapter V of his Second Treatise, Locke argues that the individual ownership of goods and property is justified by the labour exerted to produce such goods—"at least where there is enough [land], and as good, left in common for others"—or to use property to produce goods beneficial to human society. Locke states in his Second Treatise that nature on its own provides little of value to society, implying that the labour expended in the creation of goods gives them their value. From this premise, understood as a labour theory of value, Locke developed a labour theory of property, whereby ownership of property is created by the application of labour. In addition, he believed that property precedes government and government cannot "dispose of the estates of the subjects arbitrarily". John Locke

- If a man does not know how to use something, it is therefore not his property. With money, if a man does not know how to use it then he should not consider it as his property. Socrates makes the argument that a man's assets are not property unless he learns to use them diligently and wisely.

- We came here first, we planted the flag.

- "Why have stockholders?" Berle asked. "What contribution do they make, entitling them to heirship of half the profits of the industrial system, receivable partly in the form of dividends, and partly in the form of increased market values resulting from undistributed corporate gains? Stockholders toil not, neither do they spin, to earn that reward. They are beneficiaries by position only. Justification for their inheritance must be sought outside classic economic reasoning.” The position of stockholders' profit, said Berle, “can be founded only upon social grounds. There is... a value attached to individual life, individual development, individual solution of personal problems, individual choice of consumption and activity. Wealth unquestionably does add to an individual’s capacity and range in pursuit of happiness and self-development. There is certainly advantage to the community when men take care of themselves. But that justification turns on the distribution as well as the existence of wealth. Its force exists only in direct ratio to the number of individuals who hold such wealth. Justification for the stockholder’s existence thus depends on increasing distribution within the American population.Wikipedia: The Modern Corporation and Private Property

- Property rights are constructs in economics for determining how a resource or economic good is used and owned,[1] which have developed over ancient and modern history, from Abrahamic law to Article 17 of the Universal Declaration of Human Rights. Resources can be owned by (and hence be the property of) individuals, associations, collectives, or governments.[2] Property rights can be viewed as an attribute of an economic good. This attribute has three broad components,[3][4][5] and is often referred to as a bundle of rights in the United States:[6] 1) the right to use the good, 2) the right to earn income from the good, 3) the right to transfer the good to others, alter it, abandon it, or destroy it (the right to ownership cessation). Economists such as Adam Smith stress that the expectation of profit from "improving one's stock of capital" rests on the concept of private property rights. Wikipedia: Property rights (economics)

Consider best use of land and resources

- The text advocates land reform, where land is taken from landowners and farmers who own land but do not grow anything for a long time, and given to poorer farmers who want to grow crops but do not own any land.

Arthashastra

Arthashastra

Consider the social status of wealth, whether ways of achieving it are honorable, moral, reputable, legal

- For Aristotle there is a certain "art of acquisition" or "wealth-getting", which is necessary and honourable for one's household, while exchange on the retail trade for simply accumulation is "justly censured, for it is dishonorable". ... Aristotle himself highly disapproved of usury and cast scorn on making money through a monopoly.

History of economic thought

History of economic thought

- Aquinas argued it was immoral for sellers to raise their prices simply because buyers had a pressing need for a product. ... Aquinas argued against any form of cheating and recommended always paying compensation in lieu of service obtained as it utilized resources. Whilst human laws might not impose sanctions for unfair dealing, divine law did, in his opinion.

History of economic thought

History of economic thought

Justify price

- Dun Scotus thought it possible to be more precise than Aquinas in calculating a just price, emphasizing the costs of labor and expenses, although he recognized that the latter might be inflated by exaggeration, because buyer and seller usually have different ideas of a just price.

History of economic thought

History of economic thought

Determining willingness to pay

- If people did not benefit from a transaction, in Dun Scotus' view, they would not trade. Scotus said merchants perform a necessary and useful social role by transporting goods and making them available to the public.

History of economic thought

History of economic thought

- Jean Buridan argued that aggregated, not individual, demand and supply determine market prices. Hence, for him a just price was what the society collectively and not just one individual is willing to pay.

History of economic thought

History of economic thought

Consider the forms of ownership and management

- Plato also argued that collective ownership was necessary to promote common pursuit of the common interest, and to avoid the social divisiveness that would occur "when some grieve exceedingly and others rejoice at the same happenings."

History of economic thought

History of economic thought

- Though Aristotle did certainly advocate holding many things in common, he argued that not everything could be, simply because of the "wickedness of human nature". ... "It is clearly better that property should be private", wrote Aristotle, "but the use of it common; and the special business of the legislator is to create in men this benevolent disposition."

History of economic thought

History of economic thought

Use Value - Unconsciously Answering Mind

Distinguish what is more or less directly useful.

Consider the nature of wealth

- flutes are property to one who knows how to play tolerably well, but to one who does not know are nothing more than useless pebbles, unless indeed he should sell them

Oeconomicus

Oeconomicus

Distinguish what is natural and conventional

- Aristotle: Indeed, riches is assumed by many to be only a quantity of coin, because the arts of getting wealth and retail trade are concerned with coin. Others maintain that coined money is a mere sham, a thing not natural, but conventional only, because, if the users substitute another commodity for it, it is worthless, and because it is not useful as a means to any of the necessities of life, and, indeed, he who is rich in coin may often be in want of necessary food. But how can that be wealth of which a man may have a great abundance and yet perish with hunger, like Midas in the fable, whose insatiable prayer turned everything that was set before him into gold?

History of economic thought

History of economic thought

In The Theory of Business Enterprise (1904) Veblen distinguished production for people to use things and production for pure profit, arguing that the former is often hindered because businesses pursue the latter. History of economic thought

Reorganize management (division of labor)

Distinguish the basic roles in an economy (consumer, producer, distributor, regulator, etc.)

Focus on distribution of income among classes of people

- David Ricardo made a distinction between workers, who received a wage fixed to a level at which they could survive, the landowners, who earn a rent, and capitalists, who own capital and receive a profit, a residual part of the income.

History of economic thought

History of economic thought

Share management

- Ischomachus incorporates his wife into household management as soon as they are married and even relies on her to run the household. He does not hide away assets he sees as property, rather he shares them with her. He sees his marriage as a give-and-take relationship, where both he and his wife share equal parts in its success.

Oeconomicus

Oeconomicus

Trace accountability or lack of it

- In his book with American economist Gardiner C. Means (1896–1988) The Modern Corporation and Private Property (1932) Adolf Berle detailed the evolution in the contemporary economy of big business and argued that those who controlled big firms should be better held to account. Directors of companies are held to account to the shareholders of companies, or not, by the rules found in company law statutes. This might include rights to elect and fire the management, requirements to hold regular general meetings, satisfy accounting standards, and so on. In 1930s America the typical company laws (e.g. in Delaware) did not clearly mandate such rights. Berle argued that the unaccountable directors of companies were therefore apt to funnel the fruits of enterprise profits into their own pockets, as well as manage in their own interests. The ability to do this was supported by the fact that the majority of shareholders in big public companies were single individuals, with scant means of communication, in short, divided and conquered. History of economic thought

Consider how to effectively organize production

- like workmen in the street of the silversmiths, where one vessel, in order that it may go out perfect, passes through the hands of many, when it might have been finished by one perfect workman. But the only reason why the combined skill of many workmen was thought necessary, was, that it is better that each part of an art should be learned by a special workman, which can be done speedily and easily, than that they should all be compelled to be perfect in one art throughout all its parts, which they could only attain slowly and with difficulty.

Division of labour and see the Ecowiki page Division Of Labor

Division of labour and see the Ecowiki page Division Of Labor

Consider the impact of a management style

- Two styles of management that are seen in modern organisations are control and commitment:

- Control management, the style of the past, is based on the principles of job specialisation and the division of labour. This is the assembly-line style of job specialisation, where employees are given a very narrow set of tasks or one specific task.

- Commitment division of labour, the style of the future, is oriented on including the employee and building a level of internal commitment towards accomplishing tasks. Tasks include more responsibility and are coordinated based on expertise rather than a formal position. Wikipedia: Division of labour

Consider how an organization's characteristics affect its organizational behavior.

- Labour hierarchy is a very common feature of the modern capitalist workplace structure, and the way these hierarchies are structured can be influenced by a variety of different factors, including:

- Size: as organisations increase in size, there is a correlation in the rise of the division of labour.

- Cost: cost limits small organisations from dividing their labour responsibilities.

- Development of new technology: technological developments have led to a decrease in the amount of job specialisation in organisations as new technology makes it easier for fewer employees to accomplish a variety of tasks and still enhance production. New technology has also been helpful in the flow of information between departments helping to reduce the feeling of department isolation. Wikipedia: Division of labour

Budget resources to maximize productivity

Budget. Calculate what groups require to fulfill their roles.

- Locke prepares estimates of the cash requirements for different economic groups (landholders, labourers, and brokers). In each group he posits that the cash requirements are closely related to the length of the pay period.

John Locke

John Locke

Appraise. Calculate the relative value of what each group contributes to the economy.

- Locke argues the brokers—the middlemen—whose activities enlarge the monetary circuit and whose profits eat into the earnings of labourers and landholders, have a negative influence on both personal and the public economy to which they supposedly contribute. John Locke

Economists focus on how to increase productivity in a productivist mindset. The destination is more important than the journey. The ends justify the means.

- Thomas Carlyle's 1849 tract, "Occasional Discourse on the Negro Question", in which he argued in favor of reintroducing slavery in order to restore productivity to the West Indies: "Not a 'gay science', I should say, like some we have heard of; no, a dreary, desolate and, indeed, quite abject and distressing one; what we might call, by way of eminence, the dismal science."[2]

https://en.wikipedia.org/wiki/The_dismal_science

- Ludwig von Mises argues that the economic gains accruing from the division of labour far outweigh the costs, thus developing on the thesis that division of labour leads to cost efficiencies. ... According to Mises, the idea has led to the concept of mechanisation in which a specific task is performed by a mechanical device, instead of an individual labourer. This method of production is significantly more effective in both yield and cost-effectiveness, and utilises the division of labour to the fullest extent possible. Mises saw the very idea of a task being performed by a specialised mechanical device as being the greatest achievement of division of labour. Wikipedia: Division of labor

Propose or criticize a model regarding its equity or efficiency

- The Lange model (or Lange–Lerner theorem) is a neoclassical economic model for a hypothetical socialist economy based on public ownership of the means of production and a trial-and-error approach to determining output targets and achieving economic equilibrium and Pareto efficiency. In this model, the state owns non-labor factors of production, and markets allocate final goods and consumer goods. The Lange model states that if all production is performed by a public body such as the state, and there is a functioning price mechanism, this economy will be Pareto-efficient, like a hypothetical market economy under perfect competition. Unlike models of capitalism, the Lange model is based on direct allocation, by directing enterprise managers to set price equal to marginal cost in order to achieve Pareto efficiency. ... This model was first proposed by Oskar R. Lange in 1936 during the socialist calculation debate, and was expanded by economists like H. D. Dickinson and Abba P. Lerner.

- Mises described the nature of the price system under capitalism and described how individual subjective values (while criticizing other theories of value) are translated into the objective information necessary for rational allocation of resources in society.[1] He argued that central planning necessarily leads to an irrational and inefficient allocation of resources. In market exchanges, prices reflect the supply and demand of resources, labor and products. ... Mises and Hayek argued that economic calculation is only possible by information provided through market prices and that centralist methods of allocation lack methods to rationally allocate resources. Wikipedia: Economic calculation problem

Identify obstacles to reorganization

Consider the limitations on or obstacles to change in the system

- Adam Smith famously said in The Wealth of Nations that the division of labour is limited by the extent of the market. This is because it is by the exchange that each person can be specialised in their work and yet still have access to a wide range of goods and services. Hence, reductions in barriers to exchange lead to increases in the division of labour and so help to drive economic growth. Limitations to the division of labour have also been related to coordination and transportation costs. Wikipedia: Division of labour

Recognize systemic hindrances to genuine economic activity

- Verden: Output and technological advance are restricted by business practices and the creation of monopolies. History of economic thought

Exchange Value - Consciously Questioning Mind

Surveying goods: distinguishing commodities and recording their quantities

Cataloguing possessions, their types and quantities

- Giovanni Villani, as head of the mint in Florence, created a register of all of the coins struck in Florence.

Giovanni Villani

Giovanni Villani

- Conducting census of the population.

Inspect and appraise the quality of wealth

- Since the 12th century, the Trial of the Pyx is a ceremony that ensures newly minted coins of the Royal Mint conform to specifications.

Trial of the Pyx

Trial of the Pyx

Keep track of inventory

- Environmental Asset Accounting / SEEA. What is the SEEA? The System of Environmental-Economic Accounting (SEEA) is a framework that integrates economic and environmental data to provide a more comprehensive and multipurpose view of the interrelationships between the economy and the environment and the stocks and changes in stocks of environmental assets, as they bring benefits to humanity. It contains the internationally agreed standard concepts, definitions, classifications, accounting rules and tables for producing internationally comparable statistics and accounts. The SEEA framework follows a similar accounting structure as the System of National Accounts (SNA). The framework uses concepts, definitions and classifications consistent with the SNA in order to facilitate the integration of environmental and economic statistics. The SEEA is a multi-purpose system that generates a wide range of statistics, accounts and indicators with many different potential analytical applications. It is a flexible system that can be adapted to countries' priorities and policy needs while at the same time providing a common framework, concepts, terms and definitions.

United Nations System of Environmental Economic Accounting

Using random sampling

- Arthur Lyon Bowley introduced new methods of data sampling in 1906 when working on social statistics. Although statistical surveys of social conditions had started with Charles Booth's "Life and Labour of the People in London" (1889–1903) and Seebohm Rowntree's "Poverty, A Study of Town Life" (1901), Bowley's, key innovation consisted of the use of random sampling techniques. His efforts culminated in his New Survey of London Life and Labour. History of statistics

Analyze statistics to get an overall understanding

- Few studies have taken place regarding the global division of labour. Information can be drawn from ILO and national statistical offices. In one study, Deon Filmer estimated that 2.474 billion people participated in the global non-domestic labour force in the mid-1990s. Of these: around 15%, or 379 million people, worked in industry; a third, or 800 million worked in services and over 40%, or 1,074 million, in agriculture. Wikipedia: Division of labor

Document preferences for available goods

Express consumer preferences as a consumer demand curve`

- Indifference curves are heuristic devices used in microeconomics to convey preferences of a consumer graphically along with the limitations of a consumer's budget. An indifference curve shows the various combination of two goods that leave the consumer equally satisfied. For example, every point on the indifference curve I1 (as shown in the figure above), which represents a unique combination of good X and good Y, will give the consumer the same utility. The indifference curves shown in the figure above adhere to the three assumptions outlined in that they are convex, do not intersect, and have a higher utility the further the indifference curve is away from the origin. Wikipedia: Consumer choice

Ranking consumption options from least preferred to most preferred

- Utility is an economic concept that refers to the level of satisfaction or benefit that individuals derive from consuming a particular good or service, which is quantified using units known as utils (derived from the Spanish word for useful). However, determining the exact level of utility that a consumer experiences can be a challenging and abstract task. To overcome this challenge, economists rely on the consent of revealed preferences, where they observe the choices made by consumers and use this information to rank consumption options from the least preferred to the most desirable. Wikipedia: Marginal utility

Define wealth, credit and resulting choice as a proxy for well being

- All this exposed the difficulties of slowing the progression of such developments in the presence of a general ‘feel-good’ factor.

Households benefited from low unemployment, cheap consumer goods and ready credit. Businesses benefited from lower borrowing costs. Bankers were earning bumper bonuses and expanding their business around the world. The government benefited from high tax revenues enabling them to increase public spending on schools and hospitals. This was bound to create a psychology of denial. It was a cycle fuelled, in significant measure, not by virtue but by delusion. The Global Financial Crisis – Why Didn’t Anybody Notice?

Describing a consumer's utility function based on their behavior

- Consumer theory, where Samuelson pioneered the revealed preference approach, is a method by which one can discern a consumer's utility function, by observing their behavior. Rather than postulate a utility function or a preference ordering, Samuelson imposed conditions directly on the choices made by individuals – their preferences as revealed by their choices.

Ask random subjects hypothetical questions about their preferences so as to mathematically model their typical expected behavior

- Consider two scenarios;

- 100% chance to gain $450 or 50% chance to gain $1000

- 100% chance to lose $500 or 50% chance to lose $1100

Prospect theory suggests that;

- When faced with a risky choice leading to gains agents are risk averse, preferring the certain outcome with a lower expected utility (concave value function). (Agents will choose the certain $450 even though the expected utility of the risky gain is higher)

- When faced with a risky choice leading to losses agents are risk seeking, preferring the outcome that has a lower expected utility but the potential to avoid losses (convex value function). (Agents will choose the 50% chance to lose $1100 even though the expected utility is lower, due to the chance that they lose nothing at all)

These two examples are thus in contradiction with the expected utility theory, which only considers choices with the maximum utility. Also, the concavity for gains and convexity for losses implies diminishing marginal utility with increasing gains/losses. In other words, someone who has more money has a lower desire for a fixed amount of gain (and lower aversion to a fixed amount of loss) than someone who has less money. Wikipedia: Prospect theory

- ...people attribute excessive weight to events with low probabilities and insufficient weight to events with high probability. For example, individuals may unconsciously treat an outcome with a probability of 99% as if its probability were 95%, and an outcome with probability of 1% as if it had a probability of 5%. Under- and over-weighting of probabilities is importantly distinct from under- and over-estimating probabilities, a different type of cognitive bias observed for example in the overconfidence effect.Wikipedia: Framing (social sciences): Experimental demonstration

Describe a mathematical function of value

- In welfare economics and social choice theory, a social welfare function—also called a social ordering, ranking, utility, or choice function—is a function that ranks a set of social states by their desirability. Each person's preferences are combined in some way to determine which outcome is considered better by society as a whole.[1] It can be seen as mathematically formalizing Rousseau's idea of a general will. Social choice functions are studied by economists as a way to identify socially-optimal decisions, giving a procedure to rigorously define which of two outcomes should be considered better for society as a whole (e.g. to compare two different possible income distributions). Wikipedia: Social welfare function

Using particular goods or services as proxies for preference structures

Attach a money value to carry out analyses of value

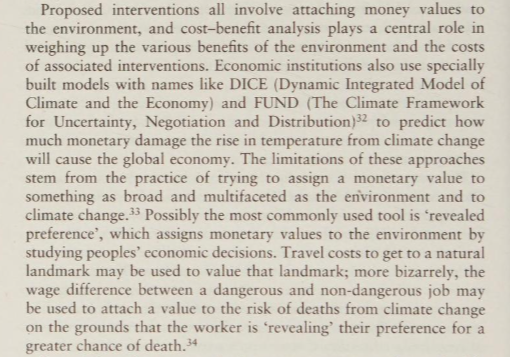

Express values in terms of money by considering preferences in particular choices. Econocracy: On the Perils of Leaving Economics to the Experts by Joe Earle; Cahal Moran; Zach Ward-Perkins:72

Contemporary mainstream economic theory frequently defers metaphysical questions, and merely notes or assumes that preference structures conforming to certain rules can be usefully proxied by associating goods, services, or their uses with quantities, and defines "utility" as such a quantification. Wikipedia: Marginal utility

Consider price formation.

Identify the characteristics, circumstances, personal qualities that assure wealth

Value X as capital based on the value of what it produces

- Locke develops an early theory of capitalisation, such as of land, which has value because "by its constant production of saleable commodities it brings in a certain yearly income".

John Locke

John Locke

Value X as money based on the value of what it can be exchanged for (or loaned out for)

- Locke considers the demand for money as almost the same as demand for goods or land: it depends on whether money is wanted as medium of exchange. As a medium of exchange, he states, "money is capable by exchange to procure us the necessaries or conveniences of life" and, for loanable funds, "it comes to be of the same nature with land by yielding a certain yearly income…or interest".

John Locke

John Locke

Apply received wisdom in managing wealth

- Consult superstition in timing when to harvest.

Works and Days

Works and Days

Consider personal qualities relevant for managing wealth

- Socrates discusses the meaning of wealth and identifies it with usefulness and well-being, not merely possessions. He links moderation and hard work to success in household management.

Oeconomicus

Oeconomicus

Discover ways to acquire more wealth

- Learn and apply the virtues of work. Don't put off work.

Works and Days

Works and Days

More recent research suggests that there is a moderate trade-off between low-levels of inflation and unemployment. Work by George Akerlof, William Dickens, and George Perry,[16] implies that if inflation is reduced from two to zero percent, unemployment will be permanently increased by 1.5 percent because workers have a higher tolerance for real wage cuts than nominal ones. For example, a worker will more likely accept a wage increase of two percent when inflation is three percent, than a wage cut of one percent when the inflation rate is zero. Wikipedia: Phillips curve

Point out the problems in a solution

Arrow's impossibility theorem is a key result in social choice theory, showing that no ranking-based decision rule can satisfy the requirements of rational choice theory.[1] Most notably, Arrow showed that no such rule can satisfy all of a certain set of seemingly simple and reasonable conditions that include independence of irrelevant alternatives, the principle that a choice between two alternatives A and B should not depend on the quality of some third, unrelated option C. Wikipedia: Arrow's impossibility theorem

Determining the value of something in terms of what it can be exchanged for.

- The value of any commodity, [...] to the person who possesses it, and who means not to use or consume it himself, but to exchange it for other commodities, is equal to the quantity of labour which it enables him to purchase or command. Labour, therefore, is the real measure of the exchangeable value of all commodities (Wealth of Nations Book 1, chapter V). Wikipedia: Labor theory of value

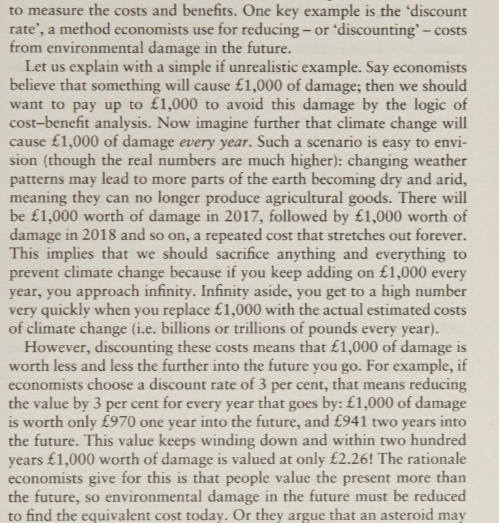

Define a transform to make two different situations comparable

- The transform can convert a future cost or benefit in terms of present costs or benefits. This can readily result in chronocentrism, the privileging of the present Wikipedia: Chronocentrism, Econocracy: On the Perils of Leaving Economics to the Experts by Joe Earle; Cahal Moran; Zach Ward-Perkins:73

Analyze choices, rationales and response of participants, as with game theory

- A second approach uses microeconomic models to explain internal firm organization and market strategy, which includes internal research and development along with issues of internal reorganization and renewal. Wikipedia: Industrial organization

- The extensive use of game theory in industrial economics has led to the export of this tool to other branches of microeconomics, such as behavioral economics and corporate finance. Wikipedia: Industrial organization

- Game theory is a major method used in mathematical economics and business for modeling competing behaviors of interacting agents. The term "game" here implies the study of any strategic interaction between people. Applications include a wide array of economic phenomena and approaches, such as auctions, bargaining, mergers & acquisitions pricing, fair division, duopolies, oligopolies, social network formation, agent-based computational economics, general equilibrium, mechanism design, and voting systems, and across such broad areas as experimental economics, behavioral economics, information economics, industrial organization, and political economy. Wikipedia: Microeconomics

Testing the hypothesis.

The main tool of the fourth stage is hypothesis testing, a formal statistical procedure during which the researcher makes a specific statement about the true value of an economic parameter, and a statistical test determines whether the estimated parameter is consistent with that hypothesis. If it is not, the researcher must either reject the hypothesis or make new specifications in the statistical model and start over. International Monetary Fund: What is Econometrics?

Gaining personal intuition by taking on a role in an economic endeavor

Marcus: participating in economic projects as practitioners

By creating and running a scheme economists have experiential learning of the operation of the economic system and aspects of it. For example running a barter network or a community currency system which shows the sharing of resources (time, money, favours, debts) in community.

- The community-based economy can refer to the various initiatives coordinated through multiple forms of interactions. These interactions may involve some form of work performance; project participation; and/or relationship exchange.

Wikipedia: Community-based economics

Observe correlations within economic data

- In the paper Phillips describes how he observed an inverse relationship between money wage changes and unemployment in the British economy over the period examined. Similar patterns were found in other countries and in 1960 Paul Samuelson and Robert Solow took Phillips' work and made explicit the link between inflation and unemployment: when inflation was high, unemployment was low, and vice versa. Wikipedia: Phillips curve

Quantifying theoretical economic models into mathematical relationships

- Econometrics uses economic theory, mathematics, and statistical inference to quantify economic phenomena. In other words, it turns theoretical economic models into useful tools for economic policymaking. The objective of econometrics is to convert qualitative statements (such as “the relationship between two or more variables is positive”) into quantitative statements (such as “consumption expenditure increases by 95 cents for every one dollar increase in disposable income”).

Develop robust statistical procedures that can deal with stark changes Theoretical econometricians investigate the properties of existing statistical tests and procedures for estimating unknowns in the model. They also seek to develop new statistical procedures that are valid (or robust) despite the peculiarities of economic data—such as their tendency to change simultaneously. Theoretical econometrics relies heavily on mathematics, theoretical statistics, and numerical methods to prove that the new procedures have the ability to draw correct inferences International Monetary Fund: What is Econometrics?

Applied econometricians apply econometric techniques developed by theorists

- Applied econometricians, by contrast, use econometric techniques developed by the theorists to translate qualitative economic statements into quantitative ones. International Monetary Fund: What is Econometrics?

Applied econometricians alert theoretical econometricians to problems with estimation techniques

- Because applied econometricians are closer to the data, they often run into—and alert their theoretical counterparts to—data attributes that lead to problems with existing estimation techniques. For example, the econometrician might discover that the variance of the data (how much individual values in a series differ from the overall average) is changing over time. International Monetary Fund: What is Econometrics?

Calculate how to maximize profit

- The underlying assumption of production is that maximisation of profit is the key objective of the producer. The difference in the value of the production values (the output value) and costs (associated with the factors of production) is the calculated profit. Efficiency, technological, pricing, behavioural, consumption and productivity changes are a few of the critical elements that significantly influence production economically. Wikipedia: Production (economics)

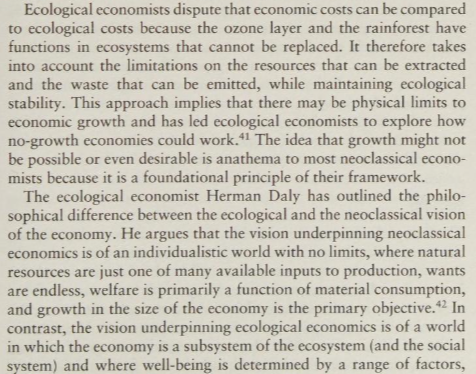

Idealize the economic environment

- Both mainstream economists and ecological economists make certain presumptions about the environment surrounding economic activity. Econocracy: On the Perils of Leaving Economics to the Experts by Joe Earle; Cahal Moran; Zach Ward-Perkins:75

- Mainstream economists working in the neoclassical tradition, as opposed to the Keynesian tradition, have usually viewed the departures of the harmonic working of the market economy as due to exogenous influences, such as the State or its regulations, labor unions, business monopolies, or shocks due to technology or natural causes. Contrarily, in the heterodox tradition of Jean Charles Léonard de Sismondi, Clément Juglar, and Marx the recurrent upturns and downturns of the market system are an endogenous characteristic of it. Wikipedia: Business cycle

Ground individuals within a social system

Socially grounded reconstructions of the individual in economic theory Wikipedia: Heterodox economics

Three Cycle

The investigatory mind links together the other two minds through the learning three-cycle.

The two minds - one defines direct value (what we consume or enjoy - usufruct), and the other defines indirect value (what can get us what we enjoy by production, exchange or other means - instrumentalisation).

Champion a value with a school of thought (and critique the policies of other schools of thought)

Schools of thought define what has direct value.

- Before World War II, American economists had played a minor role. During this time institutional economists had been largely critical of the "American Way" of life, especially the conspicuous consumption of the Roaring Twenties before the Wall Street crash of 1929. History of economic thought

- The orthodox center was also challenged by a more radical group of scholars based at the University of Chicago, who advocated "liberty" and "freedom", looking back to 19th century-style non-interventionist governments. History of economic thought

Economists find merit in formulating and defending their positions on what they choose to value or not and emphasize or not. Choosing to what in life to include or exclude in the scope of economics.

- One survey of German economists found that ecological and environmental economics are different schools of economic thought, with ecological economists emphasizing strong sustainability and rejecting the proposition that physical (human-made) capital can substitute for natural capital (see the section on weak versus strong sustainability below). Wikipedia: Ecological economics

- Anarchists[39] often add to this analysis by defending that the presence of coercive hierarchy in any form is contrary to the values of liberty and equality. Wikipedia: Division of labour

Determine what target groups value

- In 2001, China began a community-driven program for the purpose of reducing poverty levels. “Participatory village planning” was seen to have been used to promote public investments in targeted villages with higher levels of poverty. In the current program, each village conducts a public investment plan where projects are voted on by the village residents themselves. Wikipedia: Community-based economics

Identify a value beyond question that need not be regulated

- Among the authorities charged with managing these risks, there were difficulties too. Some say that their job should have been ‘to take away the punch bowl when the party was in full swing’. But that assumes that they had the instruments needed to do this. General pressure was for more lax regulation – a light touch. The City of London (and the Financial Services Authority) was praised as a paragon of global financial regulation for this reason. The Global Financial Crisis – Why Didn’t Anybody Notice?

Analyze whose interests are served. Notice historical social trends and compare with the desired reality.

- In his book with American economist Gardiner C. Means (1896–1988) The Modern Corporation and Private Property (1932) he detailed the evolution in the contemporary economy of big business and argued that those who controlled big firms should be better held to account. History of economic thought

- Means argued that where an economy is fueled by big firms it is the interests of management, not the public, that govern society. Wikipedia: Gardiner Means

Appreciate the bias in those who have or seek power

- The consumers are not the only role. So bias should be considered in the other roles. And the overall system should be considered. Econocracy: On the Perils of Leaving Economics to the Experts by Joe Earle; Cahal Moran; Zach Ward-Perkins:175

Consider who should play which roles

- The reformists' criticism of the monopolies largely centered on the idea that the state "should not compete with the people for profit", as it would tend to oppress the citizenry while doing so; mercantile ventures were not "proper activities for the state".

Discourses on Salt and Iron

Discourses on Salt and Iron

Consider the good or bad consequences of a policy

- In addition, the reformists complained that the state monopolies oppressed the people by producing low-quality and impractical iron tools that were useless and made only to meet quotas, yet which the peasants had to pay for regardless of their quality.[12] The reformers believed former private smelting by small-scale family enterprises made better implements "because of pride of workmanship and because they were closer to the users", in contrast to the state monopoly.

Discourses on Salt and Iron

Discourses on Salt and Iron

- the reformists complained that the state monopolies could not coordinate their production in accordance with the needs of all the provinces of the empire, with some areas overproducing and actually forcing the peasants to buy the surplus.

Discourses on Salt and Iron

Discourses on Salt and Iron

- The modernists took the view that with its iron monopoly the state could effectively distribute tools of good quality for the use of the peasant, as well as stabilizing the price of many essential goods. They also claimed that private workshops were too small, unspecialized, and poorly equipped. Modernists claimed the government workshops offered better working conditions and access to more materials than private workshops.

Discourses on Salt and Iron

Discourses on Salt and Iron

Consider how policies affect overall prosperity

- Policies in the early Han were marked by laissez-faire principles, due to the adoption by the early emperors of the Taoist principle of Wu wei (無為), literally meaning "do nothing". As part of their laissez-faire policy, agricultural taxes were reduced from 1/15 of agricultural output to 1/30, and for a brief period abolished entirely. In addition, the labor corvée required of peasants was reduced from one month every year to one month every three years. The minting of coins was privatized, while Qin taxes on salt and other commodities were removed. Later opponents of taxation described the early Han as a prosperous period ...

Discourses on Salt and Iron

Discourses on Salt and Iron

- Reformists gradually gained more power through the rest of Former Han, due to the growing unsustainability of the Modernists' policies.

Discourses on Salt and Iron

Discourses on Salt and Iron

Consider the relationship between individual perceptions and overall economic conditions

- wherever "good people are snubbed, and evil people are embraced" distress increases. Wherever officials or people initiate unprecedented violence in acts or words, wherever there is unrighteous acts of violence, disaffection grows. When the king rejects the Dharma, that is "does what ought not to be done, does not do what ought to be done, does not give what ought to be given, and gives what ought not to be given", the king causes people to worry and dislike him. ... where people are fined or punished or harassed when they ought not to be harassed, where those that should be punished are not punished, where those people are apprehended when they ought not be, where those who are not apprehended when they ought to, the king and his officials cause distress and disaffection. When officials engage in thievery, instead of providing protection against robbers, the people are impoverished, they lose respect and become disaffected ... where courageous activity is denigrated, quality of accomplishments are disparaged, pioneers are harmed, honorable men are dishonored, where deserving people are not rewarded but instead favoritism and falsehood is, that is where people lack motivation, are distressed, become upset and disloyal.[ ... the ancient text remarks that general impoverishment relating to food and survival money destroys everything, while other types of impoverishment can be addressed with grants of grain and money. Wikipedia: Arthashastra

Consider what parts of the economy are most profitable under a policy

- Merchants and industrialists in particular prospered during this period. In the early Western Han, the wealthiest men in the empire were the merchants who produced and distributed salt and iron, acquiring wealth that rivaled the annual tax revenues collected by the imperial court. These merchants invested in land, becoming great landowners and employing large numbers of peasants. A salt or iron industrialist could employ over one thousand peasants to extract either liquid brine, sea salt, rock salt, or iron ore.

Discourses on Salt and Iron

Discourses on Salt and Iron

Champion, implement, experiment with policy

Conducting many small experiments of alternatives to the existing system which focus on and foster a desired value

- Reimagining the economy can also mean actively creating alternative economic systems. In the words of degrowth champion Serge Latouche (2017/2018, 277), a “matrix of alternatives” is needed to remodel economic institutions as we know them (Latouche 2007/2009). A politics of degrowth, seen this way, means employing a myriad of small-scale alternatives, such as self-organised exchange systems (Chiengkul 2018), community currencies (Greco 2001), and Community Supported Agriculture (Edwards & Espelt 2020). These ideas are typically based on the idea of the community as the basis and source of economic value (Eskelinen 2020), and are therefore often called “community economies”. Petz, Bonelli, Eskelinen. Le Grand Jeu and the potential of money games for exploring economic possibilities.

- Berle served in President Franklin Delano Roosevelt's administration through the Great Depression as a key member of his Brain Trust, developing many New Deal policies. History of economic thought

Discovering the will to act

- And there is also finding the will to act and being sure that authorities have as part of their powers the right instruments to bring to bear on the problem. The Global Financial Crisis – Why Didn’t Anybody Notice?

- Another set of models tries to derive the business cycle from political decisions. The political business cycle theory is strongly linked to the name of Michał Kalecki who discussed "the reluctance of the 'captains of industry' to accept government intervention in the matter of employment".[57] Persistent full employment would mean increasing workers' bargaining power to raise wages and to avoid doing unpaid labor, potentially hurting profitability. However, he did not see this theory as applying under fascism, which would use direct force to destroy labor's power. Wikipedia: Business cycle

- In recent years, proponents of the "electoral business cycle" theory have argued that incumbent politicians encourage prosperity before elections in order to ensure re-election – and make the citizens pay for it with recessions afterwards.[58] The political business cycle is an alternative theory stating that when an administration of any hue is elected, it initially adopts a contractionary policy to reduce inflation and gain a reputation for economic competence. It then adopts an expansionary policy in the lead up to the next election, hoping to achieve simultaneously low inflation and unemployment on election day.[59] Wikipedia: Business cycle

- The partisan business cycle suggests that cycles result from the successive elections of administrations with different policy regimes. Regime A adopts expansionary policies, resulting in growth and inflation, but is voted out of office when inflation becomes unacceptably high. The replacement, Regime B, adopts contractionary policies reducing inflation and growth, and the downwards swing of the cycle. It is voted out of office when unemployment is too high, being replaced by Party A. Wikipedia: Business cycle

Consider how policies generate generate benefits or losses

- Reversing their laissez-faire policy at home and policy of appeasement of the Xiongnu abroad, he nationalized coinage, salt, and iron in order to pay for his massive campaigns against the Xiongnu confederacy, which posed a threat to the Chinese empire and a limitation to its expansion. ... Nationalizing the salt and iron trades ... produced large profits for the state.

Discourses on Salt and Iron

Discourses on Salt and Iron

- The reformists also criticized the aggressive foreign policy of Emperor Wu, which they believed had weakened instead of strengthening China, and whose costs did not justify the benefits involved.

Discourses on Salt and Iron

Discourses on Salt and Iron

- In addition, the modernists claimed that the expansionist campaigns were necessary to defend China from barbarian incursions, and that by nationalizing the salt and iron industries the state could obtain the funds needed to defend the empire without imposing additional burdens on the peasantry.

Discourses on Salt and Iron

Discourses on Salt and Iron

- Locke argues that a country should seek a favourable balance of trade, lest it fall behind other countries and suffer a loss in its trade. Since the world money stock grows constantly, a country must constantly seek to enlarge its own stock. Locke develops his theory of foreign exchanges, by which in addition to commodity movements, there are also movements in country stock of money, and movements of capital determine exchange rates.

John Locke

John Locke

Make dominant a favored way of thinking

- Make a favored way of thinking dominant by presuming it and teaching it in higher education, focusing on it in textbooks, hiring those who ascribe to it, restricting discussion to it. (This is a rather perverse way of figuring things out: You choose what you want to see, and you learn whether circumstances force you to give that up or not. It seems to be part of the learning cycle in economics.) Econocracy: On the Perils of Leaving Economics to the Experts by Joe Earle; Cahal Moran; Zach Ward-Perkins:9

- Make it seem as if currently there is no debate. Any debate was in the past. Econocracy: On the Perils of Leaving Economics to the Experts by Joe Earle; Cahal Moran; Zach Ward-Perkins:112

- Subsequently, a more orthodox body of thought took root, reacting against the lucid debating style of Keynes, and remathematizing the profession. History of economic thought

Create the university curriculum

- The ISIPE network has made a survey analyzing 347 bachelor of economics from France, Chile, Israel, Brazil, Portugal, Spain, Denmark, Mexico City, Turkey, Argentina, Italy, Germany and Uruguay. It shows that curricula worldwide are focused on math/macro/micro, which means that students mainly study the tools an economist uses without really understanding economic problems debated everyday in the media. Moreover, it shows a blatant lack of pluralism: the importance of microeconomics and macroeconomics indicates that bachelor's degrees focus on the neo-classical theory. At the same time, students cannot develop their critical thinking, as reflexive subjects such as history of economic thought or economic ethics are quasi non-existent. The situation is not much better for interdisciplinary courses and economic history. International Student Initiative for Pluralism in Economics: Survey of Economic Curricula

- Robert Skidelsky cites Imre Lakatos about science in general, where there are basic axioms, accepted working practice, and a protective belt (for accepting or rejecting dissidents). All sciences have this protective belt but in the social sciences it is particularly strong defensive structure which protects them from criticism because of the weakness of the refutation procedure. John Davis says that you have a whole way of judging the quality of research journals which favor the accepted way. Furthermore, government funds the research. Nobel Prize winner Lars Peter Hansen: This reliance on referees leads to a much more conservative strategy. I think it works against novel papers that cross subfield boundaries and that makes it all the more challenging. (Allied Social Science Association Meeting, 2017) History of Economic Thought | How & How NOT to Do Economics with Robert Skidelsky

Nobel Prize

- Note how odd it is that Economics is one of the rare fields to give a Nobel prize - and the only one that was added later.

Write a textbook

- "Economics: An Introductory Analysis". Samuelson is also author (and from 1985 co-author) of an influential principles textbook, Economics, first published in 1948. It was the second American textbook that attempted to explain the principles of Keynesian economics....As of 2018, it had sold over four million copies. ... Samuelson's textbook was a watershed in introducing the serious study of business cycles to the economics curriculum. It was particularly timely because it followed the Great Depression. The study of business cycles along with the introduction of the Keynesian approach of aggregate demand set the stage for the macroeconomic revolution in America, which then diffused throughout the world through translations into every major language. Generations of students, who then became teachers, learned their first and most influential lessons from Samuelson's Economics. It attracted many imitators, who became successful in differente niches of the college market. (NB text books are used in different ways e.g. content analysis, comparative literature, not just learning as a student.)

Hold a debate

- As complaints surfaced criticizing more and more about the government's policies, the regent Huo Guang, who was the de facto ruler of China after Emperor Wu of Han, called a court conference to debate whether the policies of Emperor Wu should be continued.[9] The resulting debate was divided into two groups, the reformists and the modernists.

Discourses on Salt and Iron

Discourses on Salt and Iron

Dominate the academic literature

- In their 1994 work, Pathologies of Rational Choice Theory, Donald P. Green and Ian Shapiro argue that the empirical outputs of rational choice theory have been limited. They contend that much of the applicable literature, at least in political science, was done with weak statistical methods and that when corrected many of the empirical outcomes no longer hold. When taken in this perspective, rational choice theory has provided very little to the overall understanding of political interaction - and is an amount certainly disproportionately weak relative to its appearance in the literature. Yet, they concede that cutting-edge research, by scholars well-versed in the general scholarship of their fields (such as work on the U.S. Congress by Keith Krehbiel, Gary Cox, and Mat McCubbins) has generated valuable scientific progress. (NB this is not about what they try to do but what they actually do).

Wikipedia: Rational Choice Model of Homo economicus Limited debate in the mainstream media

- Samuelson wrote a weekly column for Newsweek magazine along with Chicago School economist Milton Friedman, where they represented opposing sides: Samuelson, as a self described "Cafeteria Keynesian",[7] claimed taking the Keynesian perspective but only accepting what he felt was good in it.[7] By contrast, Friedman represented the monetarist perspective.

Wikipedia: Paul Samuelson Push out of an academic department

- It was created as the Cowles Commission for Research in Economics at Colorado Springs in 1932 by businessman and economist Alfred Cowles. In 1939, the Cowles Commission moved to the University of Chicago under Theodore O. Yntema. Jacob Marschak directed it from 1943 until 1948, when Tjalling C. Koopmans assumed leadership. Increasing opposition to the Cowles Commission from the department of economics of the University of Chicago during the 1950s impelled Koopmans to persuade the Cowles family to move the commission to Yale University in 1955 where it became the Cowles Foundation. Wikipedia: Cowles Foundation

Gain public support with appeals, expositions, theatre, pronouncements.(NB their surprise shows that plays were being used, but sparingly). Econocracy: On the Perils of Leaving Economics to the Experts by Joe Earle; Cahal Moran; Zach Ward-Perkins:107

Handing over responsibility: Accumulation of power, complexity of management, lack of transparency

- But against those who warned, most were convinced that banks knew what they were doing. They believed that the financial wizards had found new and clever ways of managing risks. Indeed, some claimed to have so dispersed them through an array of novel financial instruments that they had virtually removed them. It is difficult to recall a greater example of wishful thinking combined with

hubris. There was a firm belief, too, that financial markets had changed. And politicians of all types were charmed by the market. These views were abetted by financial and economic models that were good at predicting the short-term and small risks, but few were equipped to say what would happen when things went wrong as they have. People trusted the banks whose boards and senior executives were packed with globally recruited talent and their non-executive directors included those with proven track records in public life. Nobody wanted to believe that their judgement could be faulty or that they were unable competently to scrutinise the risks in the organisations that they managed. A generation of bankers and financiers deceived themselves and those who thought that they were the pace-making engineers of advanced economies. The Global Financial Crisis – Why Didn’t Anybody Notice?

- So where was the problem? Everyone seemed to be doing their own job properly on its own merit. And according to standard measures of success, they were often doing it well. The failure was to see how collectively this added up to a series of interconnected imbalances over which no single authority had jurisdiction. This, combined with the psychology of herding and the mantra of financial and policy gurus, lead to a dangerous recipe. Individual risks may rightly have been viewed as small, but the risk to the system as a whole was vast. The Global Financial Crisis – Why Didn’t Anybody Notice?

- So in summary, Your Majesty, the failure to foresee the timing, extent and severity of the crisis and to head it off, while it had many causes, was principally a failure of the collective imagination of many bright people, both in this country and internationally, to understand the risks to the system as a whole. The Global Financial Crisis – Why Didn’t Anybody Notice?

- Given the forecasting failure at the heart of your enquiry, the British Academy is giving some thought to how your Crown servants in the Treasury, the Cabinet Office and the Department for Business, Innovation & Skills, as well as the Bank of England and the Financial Services Authority might develop a new, shared horizon-scanning capability so that you never need to ask your question again. The Academy will be hosting another seminar to examine the ‘never again’ question more widely. We will report the findings to Your Majesty. The events of the past year have delivered a salutary shock. Whether it will turn out to have been a beneficial one will depend on the candour with which we dissect the lessons and apply them in future. The Global Financial Crisis – Why Didn’t Anybody Notice?

- The 19th-century school of under consumptionism also posited endogenous causes for the business cycle, notably the paradox of thrift, and today this previously heterodox school has entered the mainstream in the form of Keynesian economics via the Keynesian revolution. Wikipedia: Business cycle

- Expert policy advice and affecting public opinion (Petersen et al., 2010; Stasiak et al., 2016). Empirically, I build on 17 semi-structured interviews with Finnish economists who appear regularly in the Finnish news media. Through the interviews, I illustrate how the economist profession is mediatized. In particular, for economists who work for private banks and labor market organizations or other interest groups, the media is a central channel for political advocacy work and a major part of their job description

The mediatization of the economist profession: How economists use the media to promote political and economic interests The struggle for intellectual relevance and dominance. Cross fertilization of different traditions. Innovative connections among formerly separate theoretical traditions.

- Over the past two decades,[when?] the intellectual agendas of heterodox economists have taken a decidedly pluralist turn. Leading heterodox thinkers have moved beyond the established paradigms of Austrian, Feminist, Institutional-Evolutionary, Marxian, Post Keynesian, Radical, Social, and Sraffian economics—opening up new lines of analysis, criticism, and dialogue among dissenting schools of thought. This cross-fertilization of ideas is creating a new generation of scholarship in which novel combinations of heterodox ideas are being brought to bear on important contemporary and historical problems, such as socially grounded reconstructions of the individual in economic theory; the goals and tools of economic measurement and professional ethics; the complexities of policymaking in today's global political economy; and innovative connections among formerly separate theoretical traditions (Marxian, Austrian, feminist, ecological, Sraffian, institutionalist, and post-Keynesian) (for a review of post-Keynesian economics, see Lavoie (1992); Rochon (1999)). Wikipedia: Heterodox economics

- Welcome to the Economist Machine! A Finnish panel of economists explores what Finnish economists think about important economic topics. The questions posed to the panelists cover both current economic policy topics and classic questions in economics.

Two answers to each question. In the Economist Machine, panelists take a position on questions presented in the form of statements on a 5-point scale. For each answer, they also rate the certainty of their opinion on a scale of 1-10. In addition, panelists can supplement their answer with a comment if they wish. Finnish Economics Panel - Ekonomistikone translates as Economics machine Participation in Public Debate / Public Discussion

- The Media as a site of influence for economists. Many of the economists interviewed explained how essential it is for them to appear in the media. As a testament to the powerful societal position of economists (Fourcade, 2009), various institutions wish to use economists to harness media attention. A chief economist for an interest group stated that media appearances are a core part of his job description. The goal of the interviewee’s employer is to influence Finnish politics and policy, and the media is seen as a central sphere of debate and policy advocacy. Therefore, it is important for economists to appear in the media and to agree to

comment when contacted by journalists. "In Finland, the economic policy discussion is, to a substantial extent, based on public debate. That is where issues are framed—whether we talk about renewing EU economic rules, or the [Finnish] elections, or the budget […]. That is where the frames emerge, often through public discussion. And, of course, I am happy to contribute via public discussion." (Economist, interest group) The mediatization of the economist profession: How economists use the media to promote political and economic interests

- Lunch sessions or other types of meetings. In addition to phone calls, in-person meetings with journalists are crucial for establishing connections and creating interest. Lunch sessions or other types of meetings are ways for economists to create working relationships with journalists and get their views into the public realm. When I worked [in a former workplace], I used to have lunches with journalists every now and then, but now, that is not necessary. Now, we get enough publicity and it is all about using and maintaining the channels we have. But face-to-face meetings, lunches, coffees, and those kinds of things are useful when you want to be heard and remind people that you exist. (Economist, research institute) The mediatization of the economist profession: How economists use the media to promote political and economic interests

Analysis of bias of forecasters

- In recent years, research has demonstrated that behavioral biases play a significant role in affecting the accuracy of forecasts. The education and working experience of forecasters influence the accuracy and boldness of their predictions.[26] Forecasting accuracy is also impacted by the forecaster's experience with high inflation rates.[27] Additionally, political events such as terrorism have been shown to influence the accuracy of both expert- and market-based forecasts of inflation and exchange rates.[28] This highlights the range of external factors and biases that should be considered when evaluating the accuracy of forecasts and making informed decisions. Wikipedia: Economic forecasting

Analysis of prediction errors and justification for them

- The failure of the majority of economists to forecast the "Great Recession" caused soul searching in the profession. The UK's Queen Elizabeth herself asked why had “nobody” noticed that the credit crunch was on its way, and a group of economists—experts from business, the City, its regulators, academia, and government—tried to explain in a letter. It was not just forecasting the Great Recession, but also forecasting its impact where it was clear that economists struggled. Wikipedia: Economic forecasting

Invest money to achieve priorities

There had been programs prior to 2001 in China where investments were made to try to reduce poverty, however, these did not include much participation from the communities themselves. Wikipedia: Community-based economics

Central view

Describe the typical, idealized (rational, self-interested or otherwise) participant of an economy, the Owner

The ideal participant is the vessel for the values of the party.

Discussing an abstract representative

- Adolphe Quetelet (1796–1874), another important founder of statistics, introduced the notion of the "average man" (l'homme moyen) as a means of understanding complex social phenomena such as crime rates, marriage rates, and suicide rates.

History of statistics

History of statistics

- Gustav Theodor Fechner used the median (Centralwerth) in sociological and psychological phenomena.

History of statistics

History of statistics

Empathize with a participant as to their intent

- Adam Smith, Wealth of Nations: "He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention."

Invisible hand

Invisible hand

Watch what farmers and merchants do for the consumers and make a theory on it

- Hans-Florian Hoyer; Collect phenomena of social acts (?private and public?), which are executed by custom, apply methodical thinking. Attempt to give intentions a causality, which makes them predictable.

- Economics deals with an idealization whereby each participant is basically the same. Typically they are rational and self-interested. But even it they are not, they represent certain types. This allows for analysis of aggregates of such individuals. Econocracy: On the Perils of Leaving Economics to the Experts by Joe Earle; Cahal Moran; Zach Ward-Perkins:177

- The typical consumer can be described with their biases. But note that consumers are but one role in an economy (so see the various basic roles). Econocracy: On the Perils of Leaving Economics to the Experts by Joe Earle; Cahal Moran; Zach Ward-Perkins:175

- Bounded rationality is the idea that rationality is limited when individuals make decisions, and under these limitations, rational individuals will select a decision that is satisfactory rather than optimal.Limitations include the difficulty of the problem requiring a decision, the cognitive capability of the mind, and the time available to make the decision. Decision-makers, in this view, act as satisficers, seeking a satisfactory solution, with everything that they have at the moment rather than an optimal solution. Therefore, humans do not undertake a full cost-benefit analysis to determine the optimal decision, but rather, choose an option that fulfills their adequacy criteria. Wikipedia: Bounded rationality

- Consider the role of animal spirits - which is distinct from homo economicus. Econocracy: On the Perils of Leaving Economics to the Experts by Joe Earle; Cahal Moran; Zach Ward-Perkins:69

- Animal spirits is a term used by John Maynard Keynes (he was not the first to use the term economically) in his 1936 book The General Theory of Employment, Interest and Money to describe the instincts, proclivities and emotions that seemingly influence human behavior, which can be measured in terms of consumer confidence. The original passage by Keynes reads: Even apart from the instability due to speculation, there is the instability due to the characteristic of human nature that a large proportion of our positive activities depend on spontaneous optimism rather than on a mathematical expectation, whether moral or hedonistic or economic. Most, probably, of our decisions to do something positive, the full consequences of which will be drawn out over many days to come, can only be taken as a result of animal spirits – of a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities. Wikipedia:Animal spirits

Tease apart the internal logic of an agent (a firm)

- The need for a revised theory of the firm was emphasized by empirical studies by Adolf Berle and Gardiner Means, who made it clear that ownership of a typical American corporation is spread over a wide number of shareholders, leaving control in the hands of managers who own very little equity themselves. Wikipedia: Theory of the firm: Background

Modeling the rationality of a participant and their pursuit of total satisfaction'''

- In 1871 Austrian School economist Carl Menger (1840–1921) restated the basic principles of marginal utility in Grundsätze der Volkswirtschaftslehre[88] (Principles of Economics): Consumers act rationally by seeking to maximize satisfaction of all their preferences; people allocate their spending so that the last unit of a commodity bought creates no more satisfaction than a last unit bought of something else. Wikipedia: History of economic thought

- The Austrian school is a heterodox[1][2][3] school of economic thought that advocates strict adherence to methodological individualism, the concept that social phenomena result primarily from the motivations and actions of individuals along with their self interest. Austrian-school theorists hold that economic theory should be exclusively derived from basic principles of human action. Wikipedia: Austrian school of economics

Assume motive of agents

- Early neoclassical economists writing about rational choice, including William Stanley Jevons, assumed that agents make consumption choices so as to maximize their happiness, or utility. Wikipedia: Rational Choice Model of Homo economicus

Specify choice axioms

- Contemporary theory bases rational choice on a set of choice axioms that need to be satisfied, and typically does not specify where the goal (preferences, desires) comes from. It mandates just a consistent ranking of the alternatives.[11]: 501 Individuals choose the best action according to their personal preferences and the constraints facing them. Wikipedia: Rational Choice Model of Homo economicus

- Perfect information: The simple rational choice model above assumes that the individual has full or perfect information about the alternatives, i.e., the ranking between two alternatives involves no uncertainty. Wikipedia: Rational Choice Model of Homo economicus

- Consistent Preferences: The rational choice model assumes that preferences will remain consistent, in order to maximize personal utility based on available information. Wikipedia: Rational Choice Model of Homo economicus

- Best course of action: The simple rational choice model assumes that individuals are capable of calculating the best course of action and that they always intend to do so. Wikipedia: Rational Choice Model of Homo economicus

- Choice under uncertainty: In a richer model that involves uncertainty about the how choices (actions) lead to eventual outcomes, the individual effectively chooses between lotteries, where each lottery induces a different probability distribution over outcomes. The additional assumption of independence of irrelevant alternatives then leads to expected utility theory. Wikipedia: Rational Choice Model of Homo economicus

- Inter-temporal choice: when decisions affect choices (such as consumption) at different points in time, the standard method for evaluating alternatives across time involves discounting future payoffs. Wikipedia: Rational Choice Model of Homo economicus

- Limited cognitive ability: identifying and weighing each alternative against every other may take time, effort, and mental capacity. Recognising the cost that these impose or cognitive limitations of individuals gives rise to theories of bounded rationality.

Wikipedia: Rational Choice Model of Homo economicus

- Adam Smith’s methodological device: the reduction of all economic processes to egoism—Fiction of a simple case—F. A. Lange and A, Oncken—Buckle. Vaihinger, Hans: The philosophy of 'as if', a system of the theoretical, practical and religious fictions of mankind. § 3—Adam Smith’s Method in Political Economy . pg.184-187

Reductionism to remove emotion & humanity

- In economic terms externalities are human values such as happiness / joy e.g. sanuk in Thailand is important in day to day tasks. Yet economists regard this fun as an externality which if not instrumental (motivational) as largely irrelevant. Economists think of compulsion (the stick not the carrot) to see what is possible economically -after having split humans into "workers" and "emotional beings." sanuk

- Economics was "dismal" in "find[ing] the secret of this Universe in 'supply and demand', and reducing the duty of human governors to that of letting men alone" or personal freedom.[3] Instead, the "idle black man in the West Indies" should be "compelled to work as he was fit, and to do the Maker's will who had constructed him".[4] Carlyle also extended this imperative to other races.[3]

https://en.wikipedia.org/wiki/The_dismal_science

- Much of the empirical controversy surrounding the relationship between inflation and unemployment has focused on how people form expectations. This may be neither the most important theoretical nor the most important empirical issue. Instead, this paper suggests that it is not how people form expectations but how they use them—and even whether they use them at all—that is the issue. Economists typically assume that economic agents make the best possible use of the information available to them. But psychologists who study how people make decisions have a different view. They see individuals as acting like intuitive scientists, who base their decisions on simplified, abstract models.6 However, these simple intuitive models can be misleading; George A. Akerlof , William T. Dickens , George L. Perry. Near-Rational Wage and Price Setting and the Long-Run Phillips Curve.